Mobile Check Deposit Tips

posted on Monday, August 29, 2022 in Financial Tips

At C1st, we are happy to offer our members Mobile Check Deposit in our mobile banking app. Here are tips and tricks to help make each deposit a success!

1. Make sure the check is completed correctly

Before you snap a picture, ensure the check is payable to you or someone else on your account. Make sure the numeric dollar amount matches the written dollar amount. For example, One Hundred Dollars and no cents must match with $100.00 written in the box. If those numbers don’t match only the amount written in words can be accepted. Lastly, make sure the person issuing the check signed the bottom right hand corner. Unsigned checks will not be deposited.

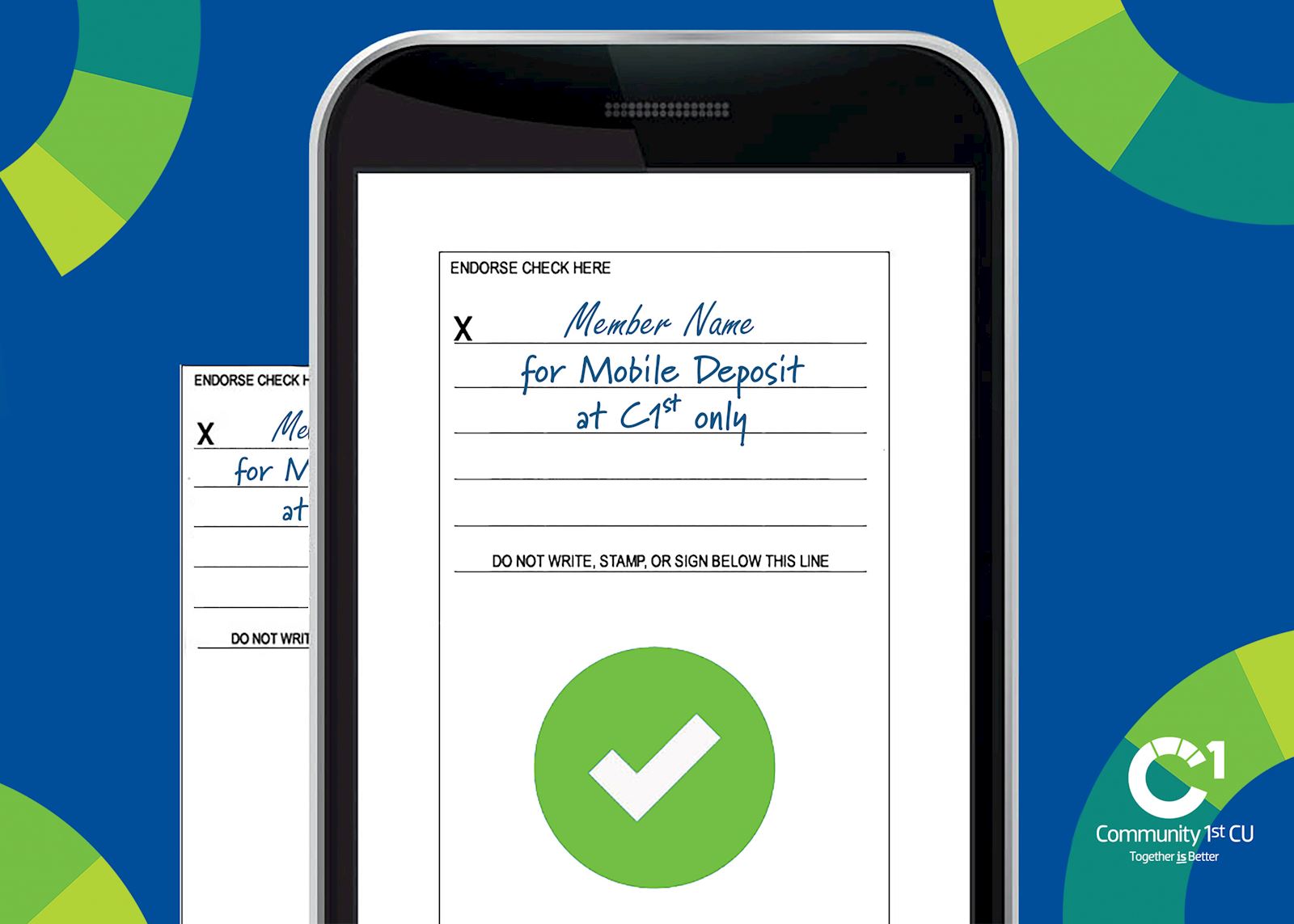

2. Endorse the check

Don’t forget to endorse the back of the check!

- Recipients must sign the back of the check.

- Write "For Mobile Deposit at C1st Only" underneath.

Please note, checks missing signatures or "For Mobile Deposit at C1st Only" may not be processed, so please be sure to follow these steps. Also, please note second-party checks that have been signed over to you can't be accepted through mobile deposit.

3. Take a better picture

Image quality is key to successfully making a mobile deposit. Be in a well-lit area, avoid casting shadows, and be willing to retake an image if your device’s camera isn’t focusing properly. The quality of the check also plays a part. Ideally, an image of the check should be clear and the necessary parts of the check should be in its respective places. Persistence and patience may be required to get a good image.

4. Keep deposited checks for 60 days

After you have deposited your check through the app, be sure you keep it in a safe place. Sometimes we will contact you about the deposit and may need you to bring it to the branch. We require you keep checks deposited through our app for 60 days. Do not write VOID across the front of it or destroy it until after this period. After 60 days checks should destroyed in a paper shredder. This helps prevent fraud and dumpster divers from finding old checks and stealing check information.

While we love to see our members, we want to help you avoid unwanted trips to our branches. By following these tips and tricks, your mobile check deposits are more likely to go through smoothly the first time.

For mobile deposit guidelines and additional information, visit our Mobile Deposit FAQ page.