Flex Home Equity Line of Credit

Our FLEX HELOC gives you an opportunity to lock in a fixed rate and make those home upgrades you planned.

In an environment where interest rates are rising, a variable interest rate can cause uncertainty in your monthly payment. You now have the option to lock a rate on a portion of your outstanding balance. Your monthly payment and interest will not change on that balance for the length of your lock period.

We've outlined some key features to help you understand our FLEX HELOC.

The basics of our FLEX HELOC:

- You can lock all or a portion of your HELOC balance into a fixed-rate during your draw period.

- You can lock a portion of your balance 2 times during your draw period

- Minimum lock amount is $5,000

- Lock terms vary from 5, 10, and 15 years

- Payments will be on a fixed principal-and-interest payment over the lock term

- As you pay down the locked balance, the available line of credit amount increases and becomes available for use during your draw period

How it works:

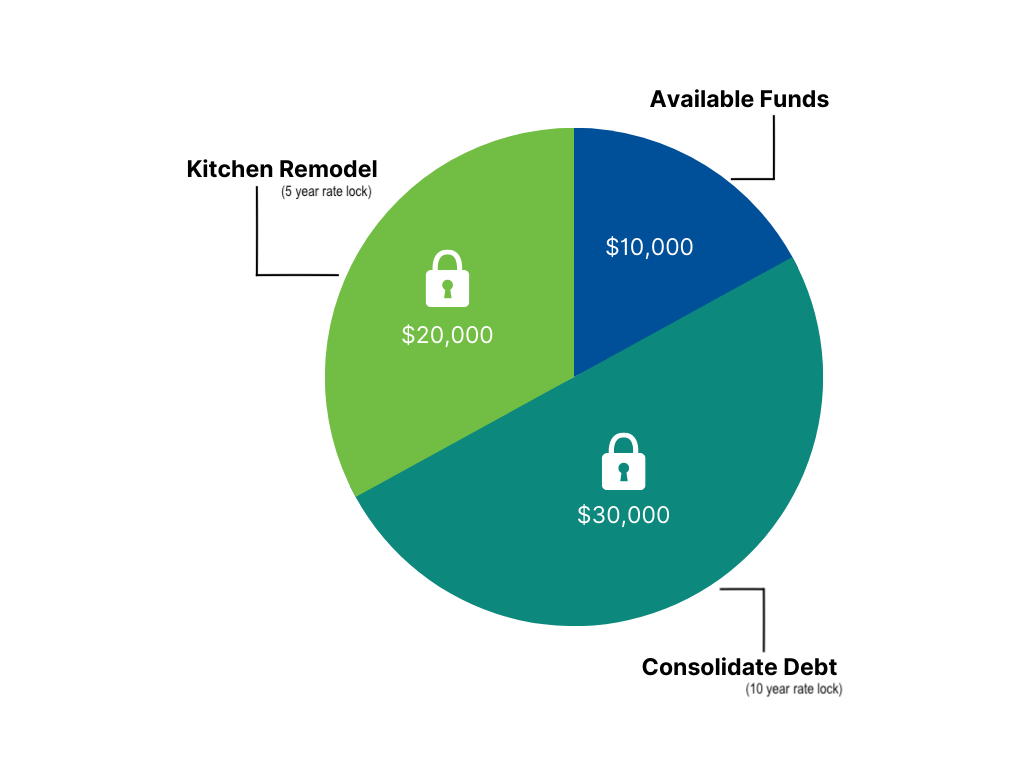

You can have up to two locks and can use either for different needs. As you pay down the locked balance on each, the available line of credit amount increases and becomes available for use during your draw period.

HELOC FAQs

- What is a HELOC?

A HELOC provides ongoing access to funds. Unlike a conventional loan a HELOC is a revolving line of credit, allowing you to borrow more than once. In that way, it's like a credit card, except with a HELOC, your home is used as collateral.

- Do I need a C1st Deposit Account to open a Home Equity Line of Credit?

Yes. Home Equity Lines of Credit are available to members of Community 1st Credit Union with a checking and/or savings account. A qualifying account may be opened during the application process.

- How do I know if I’m eligible for a Home Equity Line of Credit?

We evaluate several criteria once we receive your application for a Home Equity Line of Credit, such as your credit history, employment, income and the amount you’re requesting to borrow. We also consider your loan-to-value (LTV) ratio, which is the value of the loan compared to the value in your home.

- How much can I borrow?

Your credit score will determine the amount available in your Home Equity Line of Credit. Your credit score will determine a specific loan-to-value (LTV) ratio, and may set limits on the max amount borrowed.

- Can I apply for a C1st Home Equity Line of Credit if I’m self-employed?

Yes, you can apply for a home equity line of credit if you’re self-employed. We’ll ask for both business and personal tax returns. Other documentation may be required to further determine your ability to repay.

- Can I apply for a C1st Home Equity Line of Credit if I’m retired?

Yes, you can apply for a Home Equity Line of Credit if you’re retired. You’ll be asked to provide documentation for proof of retirement income.

- What are benefits of a Home Equity Line of Credit?

- Quick and easy access to funds. You will be able to advance funds at any time of the draw period. They can be immediately transferred into your savings or checking account.

- Multipurpose capabilities. Funds may be used for, but not limited to, home improvements or home repairs, consolidate high-interest debts, and other large expenses.

- Enjoy the benefit of a low interest rate. Home Equity lines of credit are generally lower than credit cards and personal loans.

- What happens during the closing of a new Home Equity Line of Credit and how soon can I access funds?

You'll review and sign your line of credit documents. After you sign your documents, you'll have three business days to change your mind and cancel your line of credit. This three-day period is called your "right of rescission." After these three days, you'll be able to access your line of credit.

- How do I access my Home Equity Line of Credit?

Request an advance to your account by calling us at 866.360.5370 or go to your nearest branch and a C1st Representative will be able to assist you.

You may also utilize C1st's digital banking to advance funds into your account.

- How is my monthly Home Equity Line of Credit payment calculated?

- A home equity line is based on a variable rate, and determined by the outstanding balance owed, which means your monthly payment will vary.

- During the 10 year draw period, which is the period of time you’re allowed to use your line of credit, your monthly payment will be 1% of the balance owed with a minimum payment of $100 (example: a $15,000 balance would have a $150 payment).

- During the repayment period, which is the period of time after the draw period when you’re repaying the outstanding balance, your monthly payment will be determined by the final balance owed and will vary.

- What are my payment options when I begin my repayment period?

- Continue making your monthly payments. They will be termed pending your ending balance. The rate will still be variable and payments will vary slightly.

- If you meet credit criteria you can refinance your outstanding balance into a new home equity line of credit.

*APR: Annual Percentage Rate. Introductory rate offer is effective as of 12/20/2024 and subject to change at any time. Offer is available for new home equity lines of credit (HELOC) for owner-occupied, single-family residential properties. (Current loans must be from another financial institution to refinance.) After the initial 6 months, the APR will become variable. Currently, the fully indexed rate after introductory period is 7.50% APR (WSJP + 0%) and is based on a minimum credit score of 740 and up to 90% Loan to Value (LTV). Other rates and terms apply based on the credit score and LTV. Maximum APR is 18%. The monthly payment will be 1.00% of the principal balance of the loan (applied to principal and interest, $100 minimum payment). The member has the option of choosing up to 2 fixed-rate lock requests at our disclosed rate for a period of 5, 10 or 15 years. Closing costs range from $0 (for new HELOC with $10,000 minimum initial advance) up to $720 (for existing HELOC or those with less than $10,000 initial advance) plus appraisal fees which may range from $495 to $650. This special offer requires a minimum draw of $500. Limited-time offer. Property insurance required. Subject to credit approval and qualifications. Consult a tax advisor regarding the deductibility of interest.