Say goodbye to points and hello to cash.

If you prefer online banking and use a debit card, you could qualify for some serious cash. And with each account, you'll enjoy unlimited nationwide ATM fee refunds when requirements are met. Both checking accounts are free, and require no minimum balance.

WHEN QUALIFICATIONS ARE MET: You will receive unlimited nationwide ATM fee refunds (up to $4.99 per fee assessed at domestic non-C1st ATMs) and either a premium rate OR cash back on qualifying debit card purchases, depending on your account.

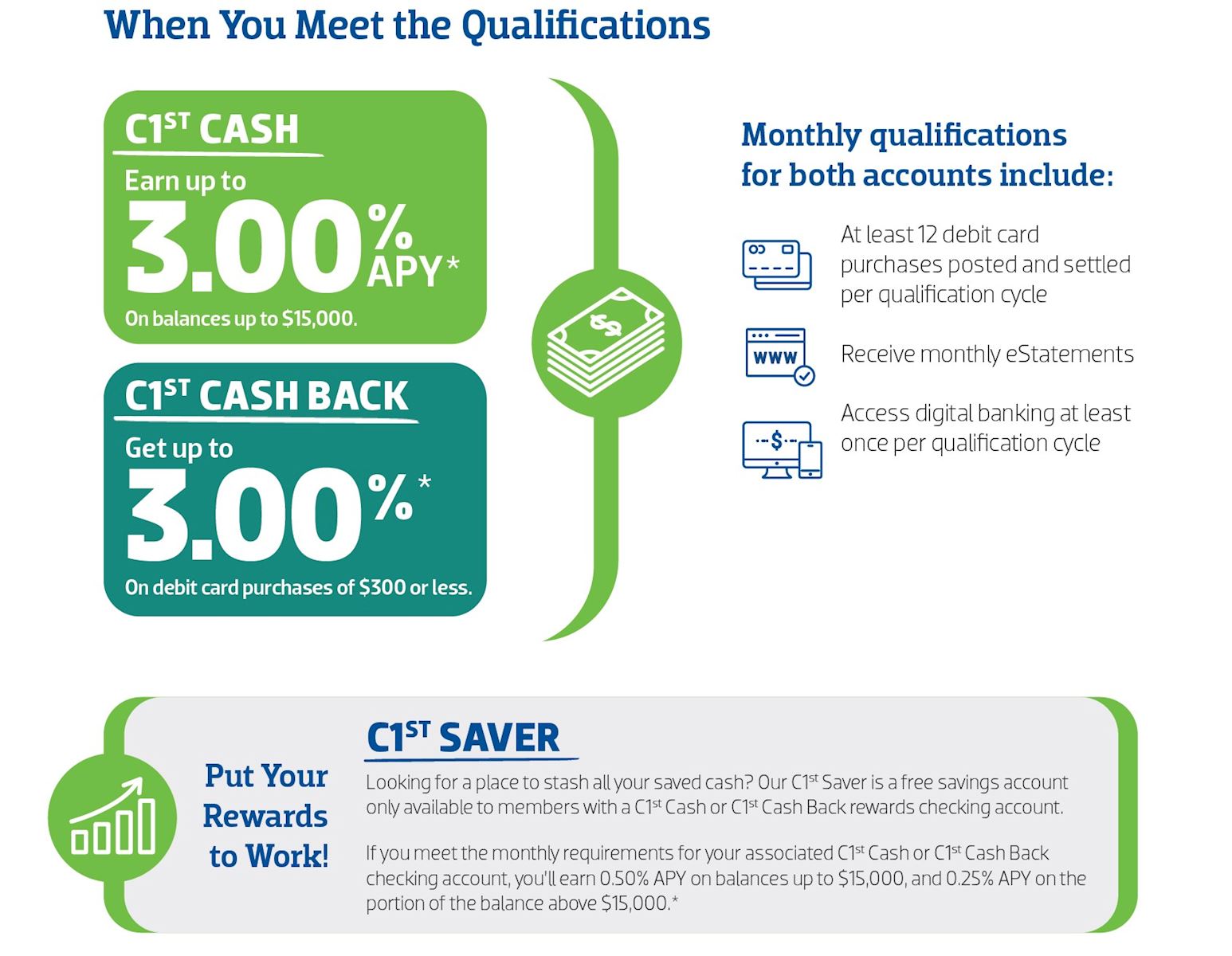

C1st Cash:

- 3.00% APY will be paid on the portion of daily balance of $15,000 or less.

- Portion of daily balance over $15,000 earns an interest rate of 0.15%, resulting in an APY of 3.00% to 0.45%, depending on the balance.

- The Annual Percentage Yields (APYs) are accurate as of the last dividend declaration date and subject to change without notice.

C1st Cash Back:

- 3.00% cash back up to a total of $300 in PIN-based and signature-based debit card purchases that post and settle to the account during that cycle period.

- Maximum cash back of up to $9.00 per monthly qualification cycle.

- ATM transactions do not qualify.

IF QUALIFICATIONS ARE NOT MET:

- ATM fees will not be refunded

- For C1st Cash: Entire balance will earn 0.03% APY

- For C1st Cash Back: You will not receive cash back on your debit card purchases.

Try again the next month.

QUALIFICATION CYCLE: To qualify, all transactions must post and clear your account during the monthly cycle which is defined as the calendar month; beginning on the first day of the current calendar month through the last day of the current calendar month.

C1st Saver: A C1st Saver account must be linked to either a C1st Cash or C1st Cash Back checking account.

If qualifications in C1st Cash or C1st Cash Back are met each monthly qualification cycle:

- Balances up to $15,000 in C1st Saver receive an APY of 0.50%

- Balances over $15,000 in a C1st Saver earn 0.25% APY on the portion of the balance over $15,000, resulting in 0.50% APY to 0.28% APY depending on the balance.

- If qualifications are not met in either checking account, all balances in the C1st Saver earn 0.03% APY.

- The Annual Percentage Yields (APYs) are accurate as of the last dividend declaration date and subject to change without notice.

Fees could reduce earnings on the account.

Limit one account per social security number. Subject to account approval. Ask us for complete details.